Place or collect my bonus (participation / intéressement)?

This content has been automatically translated.

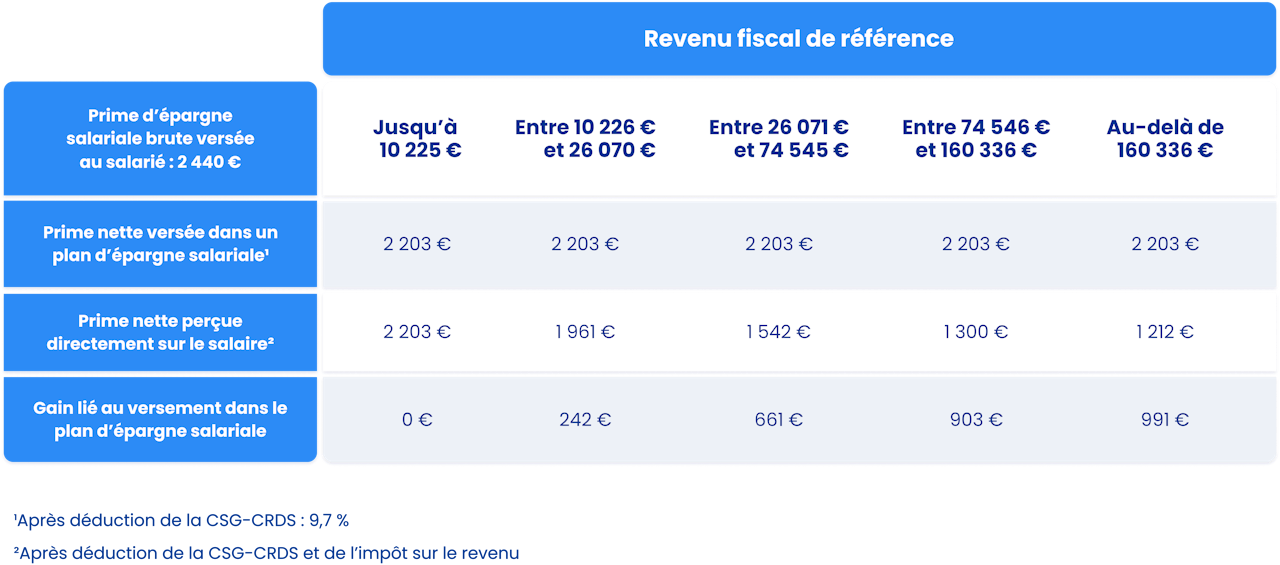

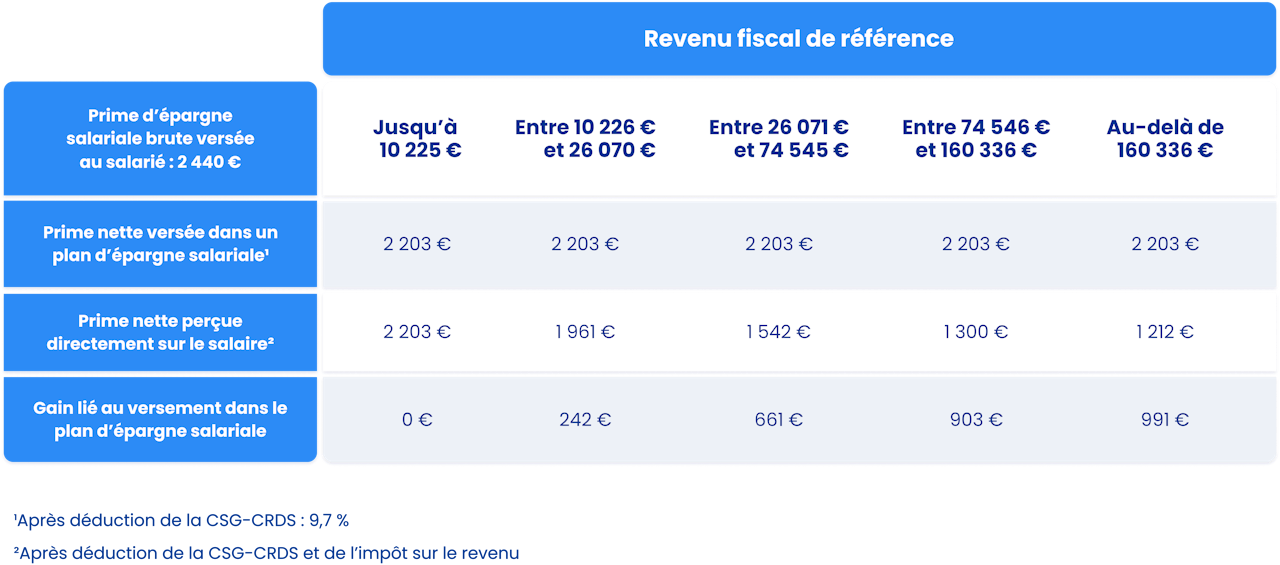

If you do not need the amounts right away , you can choose to place your premium on your company savings plans (PEE/PEI and/or PER Collective). The sums invested will in theory be blocked for 5 years on the PEE/PEI and until retirement on the Collective PER but there are cases of early release provided for by law.

Why invest your bonus ?

You will benefit from an exemption from income tax (advantageous if your tax rate is high)

You will be exempt from certain social security contributions (excluding CSG/CRDS, rate in force in 2020, 9.7%)

You will only be subject to social security contributions on the capital gains made when you release your savings.

You let the sums invested grow until your savings are released (in the long term or early)

What if I receive my bonus directly into my bank account ?

You will not benefit from any tax advantage (it all depends on your Marginal Tax Rate) and you risk seeing the net amount reduced.

You will be exempt from certain social security contributions (excluding CSG/CRDS, rate in force in 2020, 9.7%)