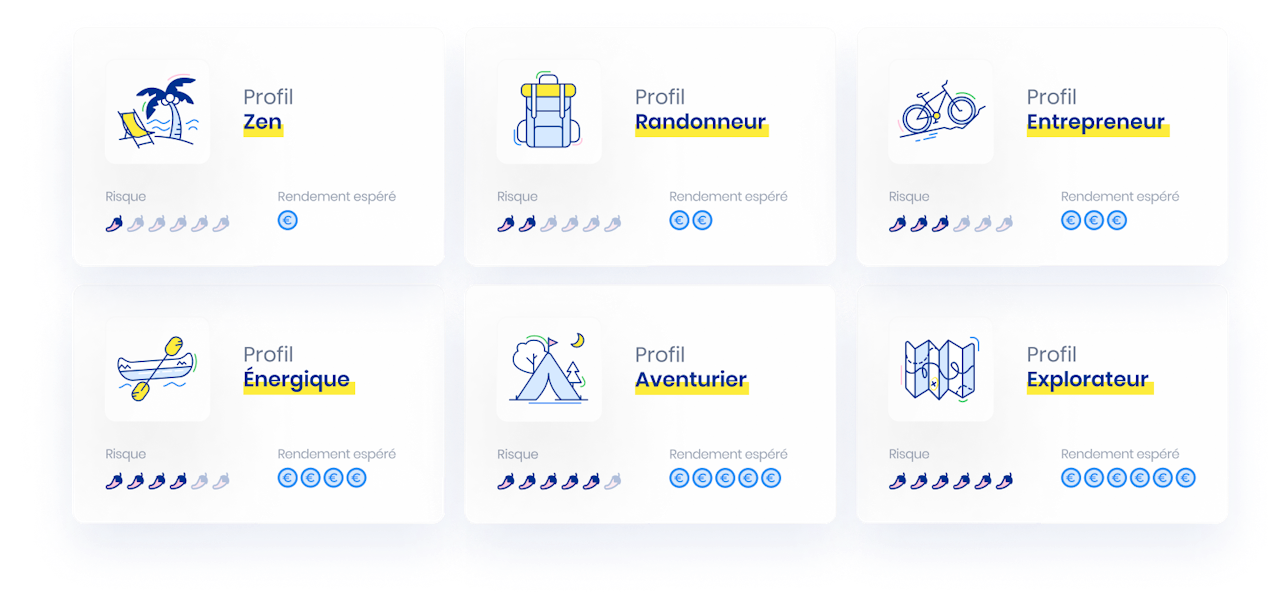

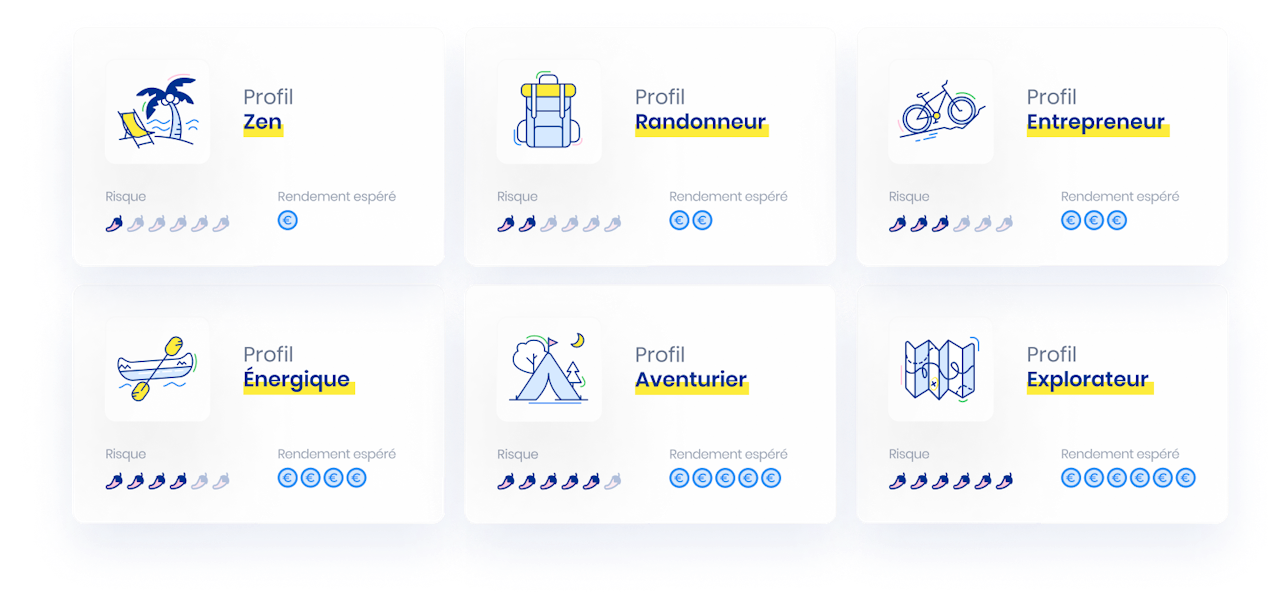

Our PEE/PEI investor profiles

This content has been automatically translated.

To guide you in your investment choices , Epsor's investment department has designed investor profiles from the least risky to the most risky with an investment allocation that varies from one profile to another. A "Zen" profile will aim to secure your savings as much as possible, whereas the "Explorer" profile will be highly exposed to risk with a significant portion placed on the stock market.

If you wish to invest your savings in the very short term (less than 1 year) :

Zen : very low level of risk, which leads to a very low expected return. Savings are 100% invested in bond funds.

💡 This profile is considered if you think you need your savings for an upcoming project and which would fit in the case of early release of the PEE/PEI (marriage, purchase of your main residence etc...).

If you wish to invest your savings between 1 year and 5 years :

Hiker : low risk level, expected return is low. Savings are invested 80% in bonds and 20% in stocks.

Entrepreneur : moderate risk level, which says moderate risk means average return. Savings are invested 60% in bond funds and 40% in equity funds.

If you wish to invest your savings for a period of more than 5 years :

Energetic : high level of risk, the expected return is quite high. Savings are invested 60% in stocks and 40% in bonds.

Adventurer : high level of risk, which leads to a high expected return. Savings are invested 80% in equity funds and 20% in bond funds.

Explorer : very high level of risk, a significant risk for a very high expected return. Savings are 100% invested in shares.