What are deductible voluntary payments?

This content has been automatically translated.

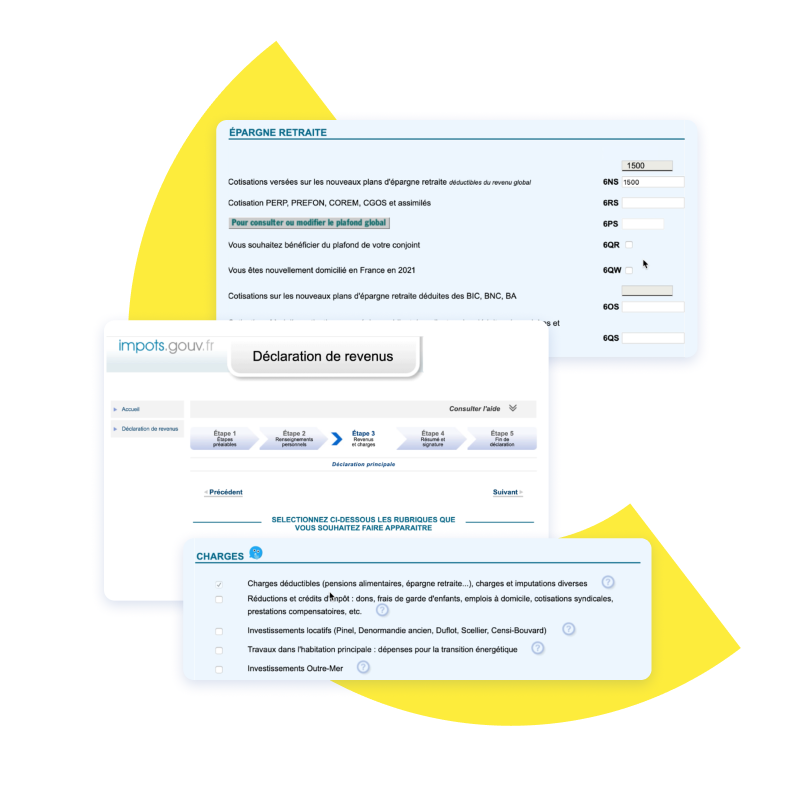

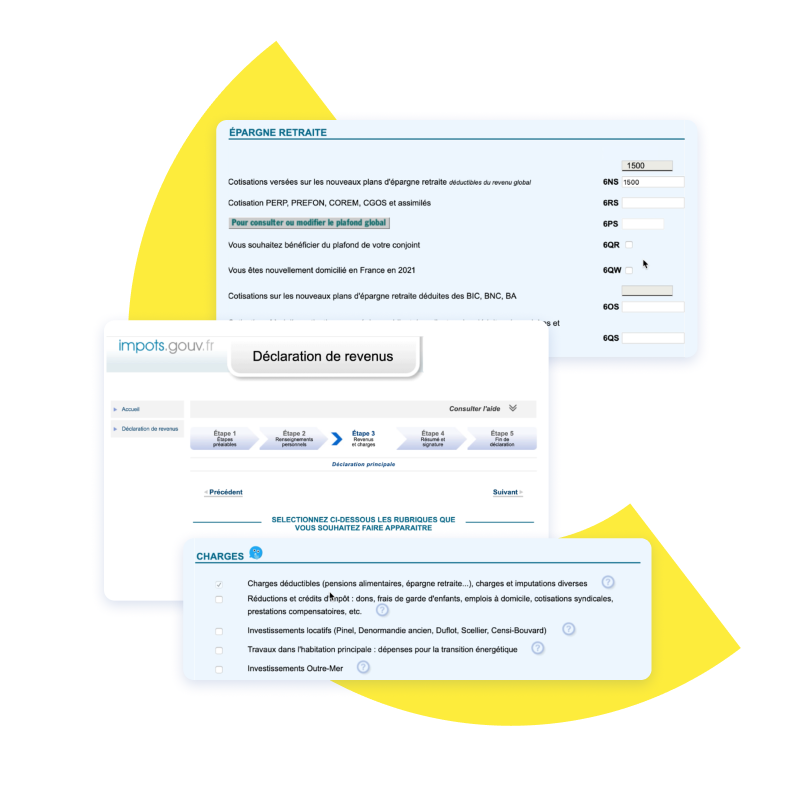

As part of the Collective PER and the Obligatory PER, you can make voluntary payments deductible from your tax base , to be declared when you file your income tax return. You can deduct a maximum of 10% of your professional income.