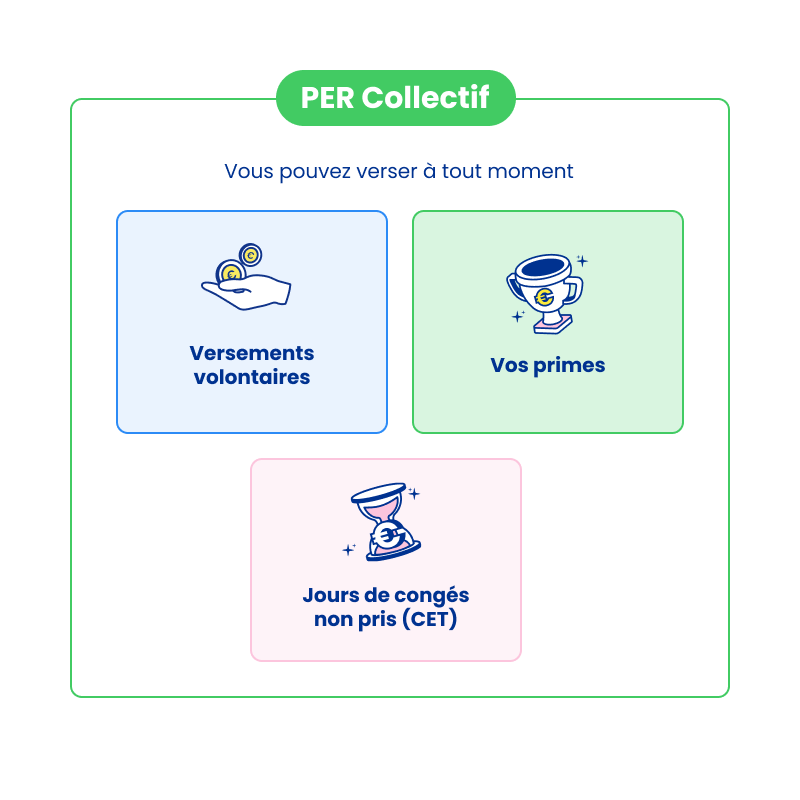

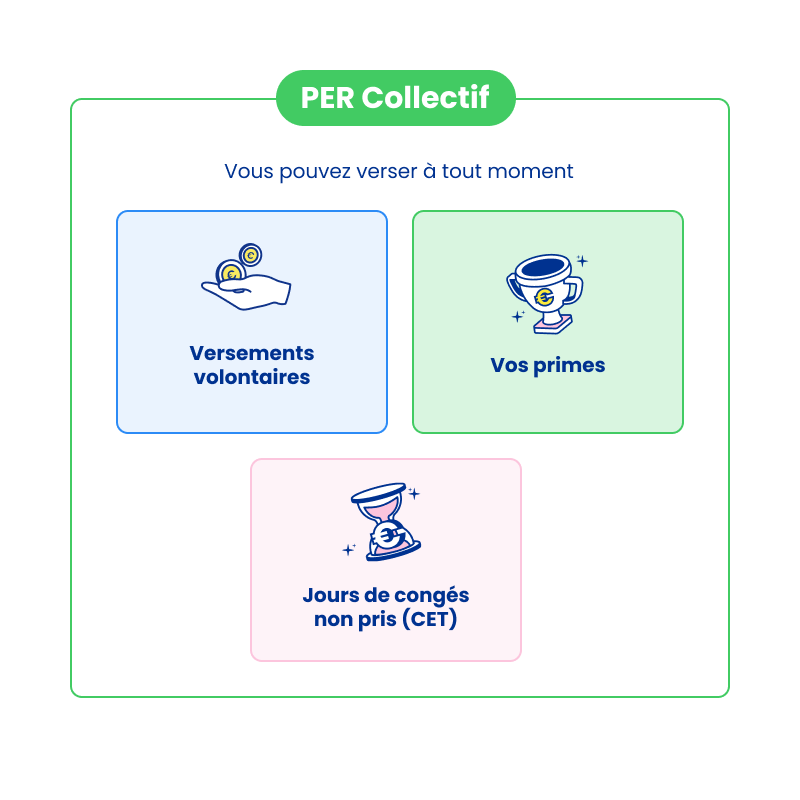

How to save on your Group Retirement Savings Plan (PER Collectif)?

1️⃣ At any time, through voluntary contributions made on an ad-hoc or regular basis to your savings plan, or by monetizing unused vacation days . It's also an opportunity to take advantage of any employer matching schemes offered by your company.

2️⃣ On the occasion of the payment of your participation and/or incentive bonuses.

How much can you save in your Group Retirement Savings Plan (PER Collectif )?

There is no limit on non-deductible voluntary contributions to this savings plan.

However, deductible voluntary contributions are capped at:

For employees:

10% of your annual professional income,

The maximum limit is set at 10% of 8 times the annual social security ceiling (PASS) of the previous year (€37,680 in 2025).

The floor is set at 10% of the PASS of the previous year (€4,710 in 2025).

For self-employed workers:

10% of professional income (BIC, BNC, BA) declared on the 2026 income tax return, up to a limit of 8 times the PASS (annual social security ceiling). This amounts to a minimum of €4,806 and a maximum of €38,448.

15% of the portion of taxable profit between 48,060 and 384,480 euros, i.e. a deductible amount capped at 57,672 euros in 2026.

These two ceilings are cumulative: a self-employed worker can therefore deduct a maximum of 96,120 euros in 2026 .